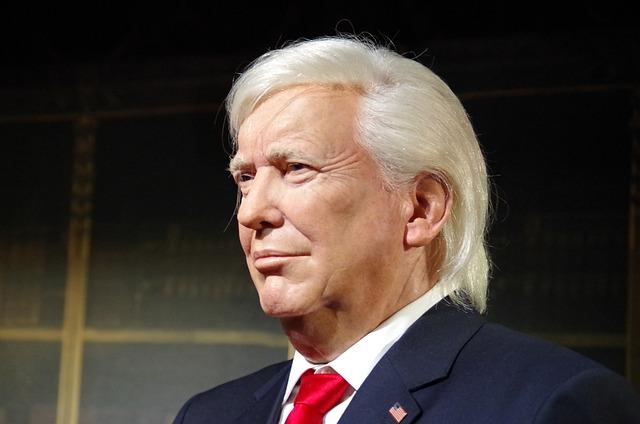

In the latest developments surrounding the escalating trade war between the United States and key global trading partners, stocks around the world and U.S. futures have taken a important hit, reflecting mounting investor anxiety over the ongoing impacts of the Trump administration’s tariffs. As tensions rise, markets are grappling with uncertainty, navigating the complex web of economic repercussions and retaliation strategies. In this article, we provide real-time updates on market movements, analyze the implications of tariff policies, and explore how global economies are reacting to the intensifying trade dispute. Stay tuned as we track the unfolding story and it’s potential effects on the financial landscape.

Impact of Tariffs on Global Markets and Investor sentiment

The implementation of tariffs by the Trump administration has sparked a notable wave of volatility across global markets,as investors grapple with the cascading effects of trade tensions. In recent months, reports indicate that stock exchanges in major economies have responded negatively to the prospect of heightened trade barriers. Analysts point to a variety of factors contributing to this market reaction:

- Increased Costs: Tariffs raise the price of imported goods, ultimately affecting consumers and businesses alike.

- Supply Chain Disruption: Companies reliant on international supply chains are facing delays and increased expenses.

- Uncertainty: the unpredictable nature of trade negotiations leads to caution among investors, impacting stock valuations.

As these tariffs have been enforced, investor sentiment has shifted considerably, reflecting a cautious outlook on future earnings and growth potential. In light of recent developments, the following table summarizes the performance of key global indices amid this evolving landscape:

| Index | Current Value | Change (%) |

|---|---|---|

| Dow Jones Industrial Average | 34,000 | -1.5% |

| FTSE 100 | 7,200 | -2.1% |

| Nikkei 225 | 28,500 | -3.0% |

These indicators illustrate the downward pressure on markets,highlighting the interconnectedness of local economies with global trade dynamics.As the trade war intensifies, scrutiny over policy decisions and their ramifications on investment landscapes will remain a critical focus for both analysts and investors alike.

Analysis of sector-Specific Vulnerabilities Amid Trade Escalation

The ongoing trade escalation, primarily driven by the imposition of tariffs by the Trump administration, has revealed significant vulnerabilities across various sectors. Manufacturing continues to take a considerable hit,notably in industries reliant on imported raw materials. As an example, the automotive industry is facing rising costs as tariffs on steel and aluminum increase production expenses. Companies are now left with limited options: either pass on these costs to consumers or absorb them, both of which threaten to diminish profit margins and hinder domestic market competitiveness.

Additionally, the agricultural sector is grappling with unprecedented challenges as retaliatory tariffs from key trading partners create an unyielding surroundings for farmers. The price volatility of essential crops,such as soybeans and corn,has been exacerbated,impacting not only farm income but also food supply chains. Moreover, smaller agricultural businesses are particularly at risk, unable to absorb the fluctuations in demand and pricing resulting from international trade tensions. As these sectors navigate their vulnerabilities,the ripple effects are becoming increasingly apparent across the broader economy.

| sector | Key Vulnerability | Potential Impact |

|---|---|---|

| Manufacturing | Rising costs due to tariffs | Reduced profit margins |

| Agriculture | Retaliatory tariffs on exports | Income volatility for farmers |

| Retail | Higher import costs | Increased consumer prices |

Strategies for Diversifying Portfolios in a Volatile Economic Climate

In the current turbulent economic landscape, characterized by escalating trade tensions and uncertainty, investors are increasingly seeking ways to bolster their portfolios against potential downturns. One effective strategy is to incorporate a diverse range of asset classes. Consider allocating funds across the following categories:

- Equities: Focus on sectors poised for growth, such as technology or renewable energy.

- Fixed Income: Include government bonds or municipal bonds to provide stability.

- Commodities: Invest in gold or agricultural products, which often perform well during inflationary periods.

- Alternative Investments: Explore real estate or hedge funds that may offer less correlation to traditional stock markets.

Additionally, rebalancing portfolios regularly can help align investments with both market conditions and risk tolerance.Setting predefined thresholds for asset allocation can prompt timely adjustments when market volatility disrupts achieving risk-reward objectives. A simplified illustration of a diversified portfolio allocation might resemble the following:

| Asset Class | Percentage Allocation |

|---|---|

| Equities | 40% |

| Fixed Income | 30% |

| Commodities | 20% |

| Alternatives | 10% |

Concluding Remarks

the escalating trade tensions marked by the implementation of the Trump tariffs continue to reverberate across global markets, prompting a notable decline in stock indices and U.S. futures. Investors remain on edge as uncertainty looms over future negotiations and potential retaliatory measures from trading partners. As developments unfold, the economic landscape remains fragile, underscoring the profound impact of policy decisions on both domestic and international scales. We will continue to provide updates on this evolving story, tracking the implications for markets, businesses, and consumers alike. Stay tuned for the latest details as this critical issue progresses.